Hey neighbors, happy Thursday.

I've never been a lottery person. No one has drawn the winning Powerball ticket yet and the pot currently sits at $1.7B ($770.3M cash value). I can't help but feel winning that would be a curse.

☠ Lottery winners file for bankruptcy at 30x the rate of regular Americans

🙃 Nearly one-third go broke despite their windfall

📊 Less than 1% of the general population files bankruptcy over five years

The problem? They didn't have to earn their money, so they don't value it. Same reason some Universal Basic Income studies show most people blow extra cash instead of building wealth.

Money without discipline lacks the built-in controls that come from earning it the hard way. Anyways.

📧 Did someone send you this email? Subscribe here.

Markets 📈

YTD

Nasdaq | $21,557.36 | +11.81% 🟢

S&P 500 | $6,471.24 | +10.27% 🟢

Bitcoin | $109,425.34 | +17.08% 🟢

Profit Profile 🤑

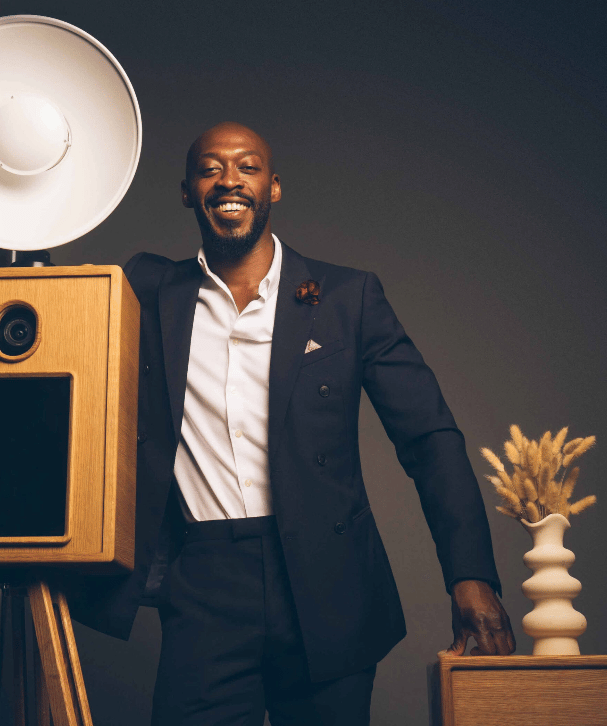

38-year-old's side hustle surpasses annual revenue goal three months early

Profit Profiles are stories about NYC entrepreneurs building and running profitable side hustles and full-time businesses.

"My aha moment was at my cousin's graduation party where I saw a photo booth for the first time. I asked what it cost — $500. I thought, 'Wait, $500 just to set that up and people come to you? I could definitely do this.'"

The grind: He still works his 7-to-3 TV job, waking up at 5 AM to be at work by 7, then using daylight hours for the photo booth business. "I'm not at the level where I would quit my full-time job yet."

Revenue growth: His goal this year was to double last year's revenue, and he’s already crushed it by September. The pricing evolution tells the story:

Started: $350 for bar mitzvahs and birthday parties

Now: $1,500+ for weddings with premium equipment and add-ons

Hit first $1K month in month four

First $5K month: December 2023

$10K months happen during wedding season (not consistent year-round)

Target customer: Couples getting married at large or prestigious wedding venues with big budgets. "My main audience has large budgets.”

Investment: Started with just $1,300 in equipment, but "the investing never stops." This month alone: almost $20,000 in new gear to handle demand (three weddings on Saturday, one on Sunday).

Biggest challenge: Finding reliable help. "People seem quite flaky, and training someone to be as knowledgeable as me with the equipment is an issue." He's actively looking for a young, energetic assistant in Greenpoint who doesn't mind late wedding season hours.

NYC advantage: "New York City is the greatest city on earth. When people see posts on my Instagram about the next big thing in photo booths, everyone wants to get on it."

Startup advice: "Just do it. Save money and cut back on a few luxuries here and there because it all adds up. Buy used equipment from Facebook Marketplace, find deals, and just start already."

Biggest mistake: Not planning ahead. "I jump in with both feet. I've learned that the further I can plan ahead, the easier everything becomes. Dealing with weddings for next year, making orders, getting certificates of insurance."

What keeps him going: "Small successes every month, like glowing reviews from brides, make me know I'm doing the right things and progressing."

Side Of Money Job Board 👷

Who’s hiring in NYC?

Director of Product, Financial Wellness at MoneyLion ($175k - $235k). Own product dev, lead a team of product managers. In-office.

Solutions Consultant at Notion ($165K – $205K). Drive product adoption and develop long-term customer success . Hybrid.

Analytics Lead at The Farmer’s Dog ($195k - $215k). Oversee data infrastructure, reporting, and analytics strategies. Hybrid.

Product Manager at Coinbase ($140k - $165k). Build stakeholder relationships, develop customer journeys, own roadmaps. Remote.

Cash Confessional 🤑

28-year-old project management consultant has $170K emergency fund; spends freely on food

Cash Confessionals are weekly stories where NYC locals peel back the curtain and expose their money habits.

Living situation: I rent a split-level three-bedroom with two roommates on the border of Williamsburg and East Williamsburg for $5,050 total. I love the space. Having two bedrooms downstairs and one upstairs makes it feel more like a home. I was able to negotiate the rent down because we signed in winter during non-peak season. If I could live anywhere, it'd be Upper West Side in the high 80s near the park in a fat brownstone. We plan to re-sign our lease.

Career: I'm a Project Management Consultant making $97k, currently working with pharmaceutical clients for the past 2.5 years. I'm not satisfied with my salary. It's a combination of not feeling valued by my company and being paid below market for my role. They cut bonuses across the whole company this year, so no bonus. My dream is to do something I love, but I wouldn't sacrifice financial stability for it. The world is too expensive and unpredictable.

Expenses: I don't really budget. I transfer about a fourth of my paycheck to savings, pay bills, then spend whatever's left. Groceries run $80-100 per week, eating out about $50 per week. My biggest expense after rent is food, which is rivaling rent at this point. I eat a lot, and I love to eat. I don't deny myself food that I want, ever. Food was a stress growing up, so I think that contributes to the 180 I've done in adulthood.

Best money decision recently: Using a high-yield savings account and investing. I'm surprised when talking with friends how few take advantage of those opportunities for financial gain.

Debt: I have $18k in student loans, no credit card debt. I paid off the high-interest loans in full when I got my first salaried job. Thinking about the expense of education in this country makes me go insane, so I try not to think about it.

Saving & investing: I save between $1,000-$1,300 per month after 401k contributions. I consider my entire $170,000 in savings as my emergency fund since it's all accessible without penalty. My boyfriend studied finance and helps me invest, plus I use Fidelity advisors. I contribute 4% to my 401k with a 4% employer match, and I have about $25k in retirement accounts. I pretty much pretend my 401k doesn't exist, which makes me treat my personal savings as my retirement lifeline.

Money rules: Don't put anything on a credit card that you can't pay off in full at that moment. Obviously this excludes medical or household emergencies, but if you don't have the cash right now for shoes, vacation, or fillers, just don't get it.

Final Reflection

What are your long-term goals? Financial stability and flexibility. I grew up without a lot of money, and it was a constant stress until I had my first salary. That plays a big role in my saving habits. Sometimes I wish I could shake some of that mentality and let myself splurge on a vacation or a beautiful bag, ya know, things I didn't experience growing up. But spending still comes with guilt and anxiety. A long-term goal would be to overcome the fear surrounding indulging. My goal for 2025 is to grow my portfolio by $30k and start dipping my toes into property ownership.

☀ NYC Weather

This weekend

Friday

70°F 🌡 82°F | ⛅ | 💨 9 mph

Saturday

62°F 🌡 83°F | 🌩 | 💨 12 mph

Sunday

57°F 🌡 72°F | ⛅ | 💨 8 mph

You’ve reached the end.

Thanks for reading this week’s edition. If you have ideas for stories, know about new business coming soon, or want to do your own anonymous Cash Confessionals submission, let me know!

Josh Stilwell

P.S.

Read something you like or maybe don’t like? Hit reply and let me know!